Introduction

Accounting is commonly known as the global language to represent the financial transactions. Similarly, accounting standards are a set of principles entities follow while preparing and maintaining the transactions through their financial statements, providing a standardized way of describing their financial performance. Normally, publicly accountable entities which can be called as listed company and financial institutions are legally required to publish their financial statements/reports in accordance with agreed accounting standards. But it does not give any liberty to other non listed or private institutions. It is because the objective of accounting is to make company’s financial transaction understandable and comparable.International Accounting Standards Board (IASB) has been working to develop such accounting principles which are known as accounting standards. Recently, The IFRS Foundation (formally called the International Accounting Standards Committee Foundation or IASCF) has developed International Financial Reporting Standards (IFRS) which are a set of accounting standards developed with the belief that a single set of IFRS is in the best interests of the global economy.

Though, the IFRS has been developed and implemented with the goal to make the financial markets more efficient, it has been criticized with different arguments. Some have argued that implementation of IFRS is expensive and some said requirement of IFRS is only for the listed company and is not mandatory to private or non-listed whose shares are not traded through capital markets. But it is that the benefit from more efficient financial markets is bigger than the cost of adopting IFRS. Similarly, the overall reason of IFRS is definitely to create a global language that makes it easy for investors to make comparisons and assessments of different companies all over the world. But IASB would also like to go further and make it possible to also compare companies listed on stock markets with companies that are not. IASB wants to prohibit inconsistency in accounting not only among different listed companies but also between non-listed and listed companies.The ideas behind IFRS are that investors should be able to make comparisons betweencompanies and that accounting should be produced with the aim to show theinvestors/owners the market value of the company. This would make it possible forcapital to be moved from less efficient business to more efficient business.Consequently IFRS do emphasis a focus on the fair value and the balance sheetinstead of traditional historic or conservative assessment (Barlev and Haddad, 2003).

Nepalese Accounting Standards (NFRS)

As a WTO member country and a participant of globalization phenomenon, Nepal has enormous opportunity of bringing foreign investment to the country. Both of the status, as an opportunity not only build the capital within the country but also integrate the economies through the movement of goods, services people and information across national boundaries. Integration of economies and societies around the world along with our linkage to them and movement of investment ultimately demand cross border transactions and activities which were complicated by other countries maintaining their different sets of standards with us. Therefore there should be the uniform sets of standards known as global standards i.e. IFRS for global markets including us.

In Nepal, Accounting Standards are developed by the Accounting Standards Board (ASB). The ASB came into existence on 10 March 2003 as per the provisions of Nepal Chartered Accountants Act, 1997. Approval of accounting standards and related documents, such as the conceptual framework of financial reporting, exposure drafts, and other discussion documents, is the responsibility of the ASB. ASB has set accounting and financial reporting standards in line with the International Financial Reporting Standards (IFRS) known as Nepal Financial Reporting Standards (NFRS).

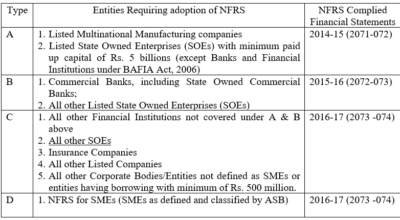

The Council meeting of ICAN on 13 September 2013 decided to pronounce 27 NAS and 13 NFRS including IFRICs and SICs for implementation upon the recommendation from ASB. These standards are prepared in line with IAS, IFRS, IASB framework and all interpretations and are being phased in for implementation for different class of entities as below, starting from 2014-15, subject to implementation of NFRS-9, Financial Instrument only from 16 July, 2015 onwards.The table below shows the organizations that require adoption of NFRS and the period for NFRS complied financial statements. Commercial Banks are required to publish NFRS complied Financial Statements for FY 2015/16 and financial institutions the period is 2016/17.

Source: www.ican.org

EPF’s Preparation

There is a mandatory provision in EPF Act, 2019 BS (with 9th amendments) in which it is clearly stated that the structure/format of the Financial Statements (FS) of EPF is to be designed and approved from AOG. Furthermore, Section 23 clearly states that the structure/format of Account /Financial Statements should be as per the format of AOG.Therefore, though EPF has its own account manual consisting of accounting code, accounting policies etc and is governed from its own Act, the changes in Financial Statements because of the implementation of NFRS are supposed to be approved from the AOG. Moreover, Section 15 of financialbylaws (Arthik Parsasan Niyamabali) states that the account should be kept as per the prevailing accounting standards and accounting policies approved by Board under the provision 23 of EPF Act which make EPF little bit easier to convert into NFRS.

As per ICAN, EPF is required to prepare and publish NFRS complied FS for FY 2073-074 (BS). But an issue of gradual implementation of IFRS/NFRS has been raised for the first time on MOU, documents prepared for the appointment of Administrator of EPF under then Sasthan Nirdeshan Board, betweenNepal Government and then administrator of EPF at 2012. In last five years, the preparatory work of EPF towards IFRS/NFRS implementation seems very slow. There might have the reason that the announcement of implementation was voluntary but the time has passed way and it became mandatory for us. Following activities can be summarized as initiatives that EPF has taken during these last five years.

- EPF has formed the NFRS Core team in 2014, as a very first step towards its preparation, which has been reconstituted in 2015.

- Nepal Government, Ministry of finance has also informed that the Government has also planned to implement NFRS to public sector from FY 2014 – 2015 and asked EPF about the preparation.

- To speed up the implementation, EPF Board has formed Panel of Experts comprising representation from various government entities and professional bodiesin 2015 to supervise monitor and facilitate the NFRS core team.

- In December 2015, EPF appointed the expert to review the GAP between NFRS and prevailing accounting and also to suggest the accounting policies to be changed thereon.

- Second time, the NFRS Core team has been reconstituted in 2017 to focus the implementation and has appointed the expert, second time, to prepare the structure/format of Financial Statements and to recommend the amendments needed in prevailing FS for NFRS implementation based on the gap analysis report and existing accounting manual of EPF in September 2017.

Besides that, to make cost effective adoption of NFRS, EPF has set priority on three categories of inputs namely; internal human resources within the organization, the external resources i.e. experts to some functions and its own information technology (IT) resources. In our context, timely change of accounting policies and account heads, amendment of the accounting bylaws and approval of format of FS from various internal as well as external authorities are essential for effective adaptation.

Moving forward

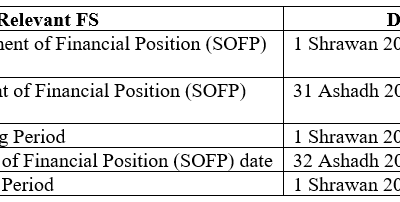

EPF has anticipated that the coverage of IFRS/NFRS would be mandatory to all entities some years back. This foresight made EPF consider the requirements and plan the preparatory works in early days when the regulatory institution, ICAN itself was preparing in national prospective in this regard. Though the EPF’s preparation for implementation is delayed by one financial year, EPF is planning to prepare and publish NFRS based financial statements for FY 2074/075 in which followings will be the corresponding dates for the convergence.

Prevailing accounting of EPF regarding recognition, measurement, presentation and disclosure of items may not be in line with the provision of IFRS/NFRS. Normally there are three steps (can be sub divided into more) in effective implementation. First step, also called as scoping and planning in which normally areas where significant effort is required are identified. Second, called as designing and building in which requirements of IFRS implementation and its choices are identified and last step known as implementation and review in which the implementation takes place. EPF has already identified the major areas where significant effort is needed. Probably, contributor’s fund, employees’ benefits, house rent, treasury and investment, classification of assets, contributor’s loan and its provision and interest of loan along with the format/components of financial statements are the major areas in which prevailing accounting defers with the requirements of the standards. In our context, second and third steps need expert opinions and top level decisions because there are significant number of choices and judgments in IFRS/NFRS. These choices and judgments can significantly affect the results of operations, financial position and cash flows as reported thereon.

Things to pay

Unlike majority of the entities in the industry, EPF is using its own internal resources in this change. The use of internal resources to design the conversion plan, interpret standards, impart knowledge to line, staff and executives, and implement and assess the effectiveness of internal controls throughout the conversion seems cost effective in comparison to hiring experts or taking services from professionals. Using experts may give the output to organization without any delay. Both approaches have their own merits and demerits but in long run successful implementation is the development of accounting personnel who have knowledge of NFRS standards within the organization. Accounting personnel do not necessarily have to become experts in NFRS, but they should have a strong working knowledge of the standards that are of greatest concern in their industry. The second issue EPF should consider is Information Technology (IT) which may need to be modified for implementation. EPF might consider simultaneously changing its IT platforms, or reevaluating the useful lives of assets. Similarly, NFRS related changes may require the modification on contractual and operational arrangements. At last, it can be concluded that while NFRS is principles-based, there are complexities. First time adopters need assistance from internal as well as external resources to resolve these complexities. If the changes and its impact over our financial statement are anticipated properly at earliest, EPF should not reverse the gear from NFRS implementation.