Employees Provident Fund Considers Interest of Contributors Rather Than Profit

The Employees Provident Fund (EPF) established for the welfare of all government employees has completed over six decades’ journey. This institution has provided significant contribution to the overall service of employees and to social security sector as well by mobilizing fund equivalent to Rs 500 billion.

EPF has also established itself as a leading institution investing in Nepal’s infrastructure development sector, especially in the hydropower projects. It is in final preparation for the construction of the Betan Karnali Hydroelectricity Project through its subsidiary company. EPF has invested Rs 22 billion for the purchase of aircraft for the national flag-carrier, Nepal Airlines Corporation.

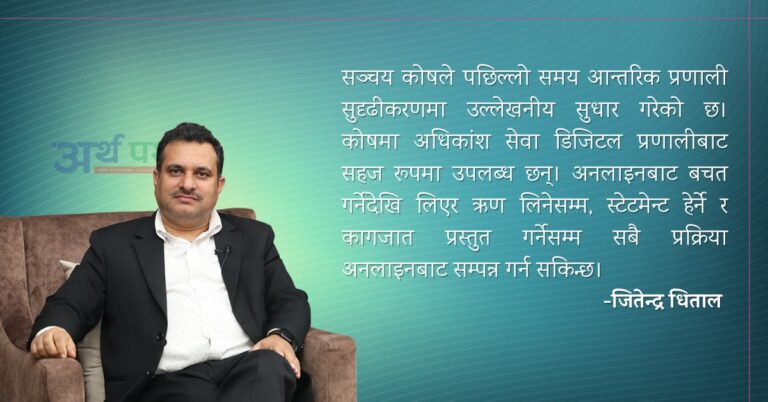

Rastriya Samachar Samiti (RSS) reporter Ramesh Lamsal sat down for an exclusive interview with Jitendra Dhital, Administrator of the Employees Provident Fund (EPF), to discuss a range of topics, including the fund’s recent activities and its focus on contributors’ interests and welfare. Here are the key excerpts from the interview:

What activities has the EPF been carrying out in recent days?

The Employees Provident Fund is a leading institution of the country with a history of over six decades, and we have been emphasizing on strengthening and modernizing the organization. We have digitized our operations, moved towards internal reforms, and provided smooth and easy services to our members and contributors. With a capital of over Rs 500 billion, we are focused on enhancing our portfolio and credibility while ensuring secure and systematic fund mobilization. We have undertaken internal reforms in various aspects, including policy, regulation, and guidelines.

How does EPF prioritize contributors’ interests and welfare?

EPF operates with the primary goal of focusing on the interests and welfare of the contributors. Unlike profit-oriented banks and financial institutions, we mobilize more than 90 percent of our earnings and profits for the benefit of our contributors. We provide financial support to contributors while they are still in service, offering easily accessible loans with lower interest rates compared to deposit interests. We have also implemented various social security programs, such as compensation for accidents, medical treatment, post-partum support, and restitution for medicines and treatments, benefiting both contributors and their families.

How does EPF collaborate with government bodies to manage liquidity and interest rates?

EPF collaborates with regulatory bodies like Nepal Rastra Bank (NRB) and the Ministry of Finance to determine liquidity and interest rates. We work closely with these institutions to maintain stability and balance in the financial system. While we could have intervened in interest rates as a significant institutional depositor, we prefer to work collaboratively and responsibly with state bodies to ensure smooth financial operations.

Critics suggest EPF’s investments in big commercial banks raise concerns about market intervention. What is your response?

EPF, as an institution under the Government of Nepal’s Ministry of Finance, does not directly control interest rates like commercial banks. The comparison between profit-oriented banks and EPF is not entirely fair, as we have distinct objectives of providing social security to our contributors. Our investments are focused on Nepal’s infrastructure, particularly in the hydropower sector, which is a matter of pride for us.

EPF has invested in Nepal Airlines Corporation (NAC), and there are concerns about loan repayment. What is the situation?

We have provided significant financial support to NAC, and their liabilities have been increasing, especially during the COVID-19 pandemic. While they have paid installments to us in the past, their present status and lack of transparency raise concerns. We cannot provide additional loans to NAC in its current condition.

What is the progress of the Betan Karnali Hydropower Project, and how does EPF plan to overcome challenges?

The Betan Karnali Hydropower Project is in its final preparation phase for construction. While there have been challenges with leadership changes, we are now focused on finding a CEO and working collaboratively to move the project forward. Investment in the hydropower sector does not yield immediate returns, but we are confident about the project’s success in the long run.

What new programs is EPF introducing for contributors’ benefit?

We are introducing new loan programs, including home loans and educational loans, to expand services beyond the current 32 districts. Additionally, we are working on housing programs through EPF’s subsidiary company, aiming to construct apartments for employees. Our goal is to provide systematic and qualitative benefits to our contributors.

Any concluding remarks?

EPF recognizes the need to effectively communicate its activities and services to all contributors, including those not well-versed in technology. We thank RSS for this opportunity to bridge the communication gap and assure our commitment to contributors’ interests and welfare.